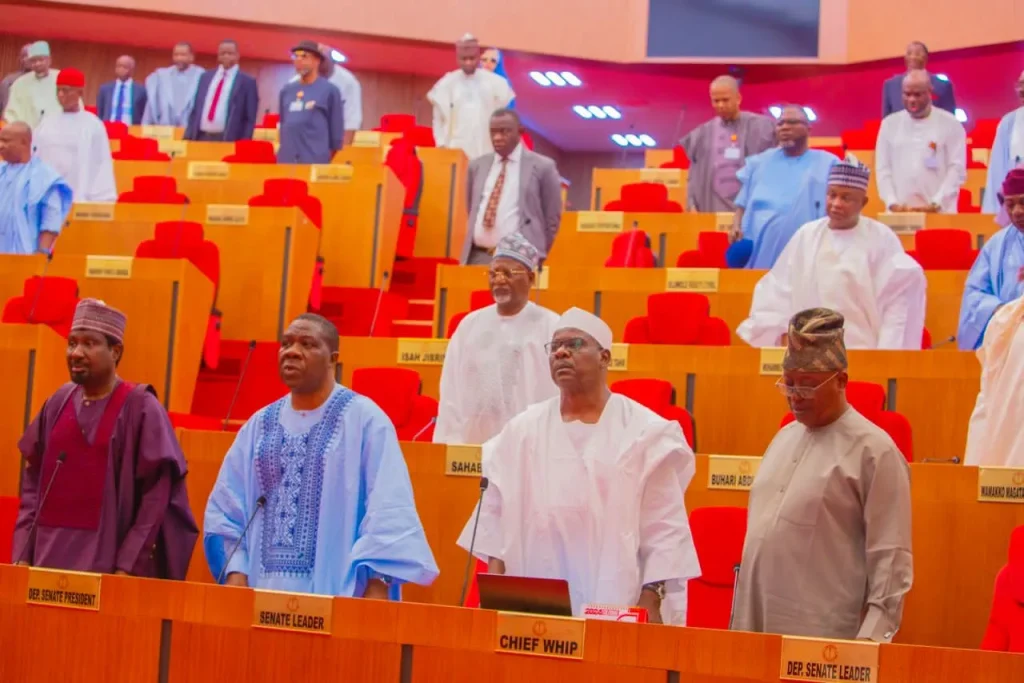

CurrentReport Blog The Nigerian Senate on Thursday passed four tax reform bills proposed by President Bola Ahmed Tinubu for a second reading, marking a significant step toward overhauling the country’s taxation framework.

The bills, introduced by Senate Majority Leader Opeyemi Bamidele, aim to simplify tax laws, reduce burdens on small businesses, and streamline tax collection processes. During the debate, Bamidele emphasized the importance of eliminating double taxation and improving revenue sharing.

Key Proposals in the Tax Reforms

- Increased State Share of VAT Revenue: State governments’ share of Value Added Tax (VAT) revenue would rise from 15% to 55%.

- Exemptions for Low-Income Earners: Salaries below the minimum wage would be tax-exempt.

- Enhanced Efficiency: The reforms address inefficiencies in tax administration and aim to provide clarity in tax statutes.

“These bills will bring clarity to tax statutes, exempt salaries below the minimum wage, and address long-standing inefficiencies in tax administration,” Bamidele said.

While many senators supported the reforms, opinions were divided:

- Senator Seriake Dickson (Bayelsa West): Highlighted the importance of a transparent taxation system and reducing Nigeria’s dependence on oil revenues.

- Senator Ali Ndume (Borno South): Raised concerns about the timing and potential constitutional challenges, suggesting the need for further legislative scrutiny.

- Chief Whip Tahir Monguno: Advocated for advancing the bills, stating they can be refined during public hearings to ease the tax burden on Nigerians.

The bills, which were introduced following President Tinubu’s October request, will now proceed to public hearings and further legislative work. Senate President Godswill Akpabio facilitated their passage to the next stage after a majority vote.

If enacted, the tax reforms could modernize Nigeria’s revenue system, improve economic efficiency, and provide relief for small businesses and low-income earners. However, challenges such as constitutional amendments and stakeholder consensus remain critical for their success.